The Annual Fund

The Annual Fund takes WashU across the finish line each year, helping to bridge the gap between tuition and endowment income. It offers immediate, flexible support for all aspects of a WashU education — including scholarships, professorships, paid internships, faculty research, facilities, classroom technology, and so much more:

- When a promising student needs a small boost in financial aid to attend WashU, the Annual Fund ensures that cost is never a barrier.

- When a dean recruits a world-class scholar, the Annual Fund strengthens the offer, funding research, teaching resources, and laboratory startup costs that elevate WashU’s academic excellence.

- When a STEM lab needs updated equipment, the Annual Fund provides the latest industry-standard technology, preparing students for real-world careers.

Choose a funding priority

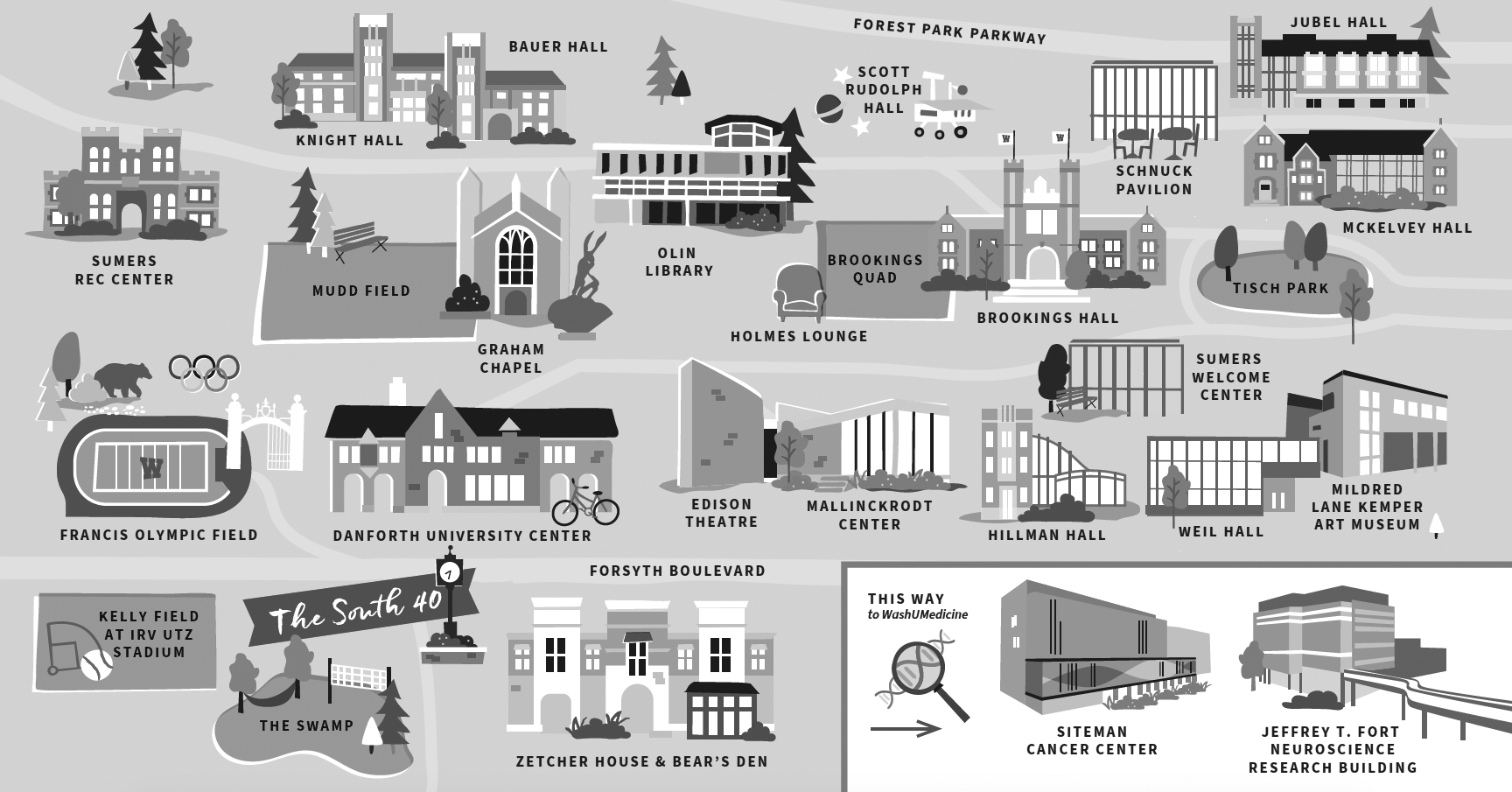

Your Annual Fund support lights up every aspect of the WashU experience. Click to see it in action.

WashU’s endowment

The endowment is a pool of financial capital formed primarily with gifts from donors, similar to a mutual fund. It is a permanent asset whose purpose is to sustain the university across generations.

Each year, a careful portion of the endowment’s income earnings — referred to as the annual payout — is distributed to support the university’s operational budget and highest priorities. The principal is preserved and the remaining earnings reinvested to provide reliable, predictable funding year after year. As the endowment grows, so does WashU’s capacity to expand access, attract world-class scholars, and drive breakthrough discoveries.

Because our endowment is meant to provide intergenerational support, it’s fundamentally different from personal investments like retirement accounts, which are meant to be cashed out during the investor’s lifetime. Also, the time horizon for our endowment is much longer than that of individual investments.

See how an endowed gift grows over time

This simplified calculation is for illustration purposes only and assumes both the unit value and payout rate remain the same. Conservatively, we are assuming an annual return of 7% and a payout of 4%. This would allow the market value to grow by 3% each year.